Week 8 Recap: Testing Purchase Intent

In Week 8, we discussed how the only real way to test purchase intent is to offer to sell your product or service – and see if your paying customer will sign up to be notified, pre-order, or issue a Letter-of-Intent (LOI) or Memo-Of-Understanding (MOU).

This is critically important not only for your venture, but for fundraising, for the following reasons.

- It forces you to be clear about who your paying customers are. Being able to test purchase intent forces you to get specific about your paying customer. It also it forces you to give them an offer and “do the ask”, which can be very difficult for first time entrepreneurs.

- It forces you to be clear about what value you bring to your customers. You are asking them to pay for your product or services. That means you need to be crystal clear about the benefits and unique value proposition (UVP) of your solution. It also means you are able to communicate it effectively in a variety of formats, written and spoken.

- It generates measurable traction that helps you raise money. A good outcome from a purchase intent test is the traction that many funders will be looking for when they consider whether to support you with an injection of cash. In many cases, having this traction is a pre-requisite to raising money, which is the topic of this week’s update.

Week 9 Focus: Fundraising and team

In Weeks 6 and 7, we discussed how cash is king. We explored how revenue is the best source of cash in many cases.

However, many early ventures are not able to generate meaningful revenue. This is particularly true of tough tech / biotech ventures (which need years of development before they can charge for their solutions), and non-profits (which need time to build an earned-income revenue stream). In these situations, you will need to raise money.

Sources of capital for every entrepreneur

For entrepreneurs that are just getting started, there are several sources of capital:

- University competitions, prizes and awards: For eligible student and alumni entrepreneurs, there are university-sponsored competitions, prizes and award programs that yield cash prizes, in-kind services, or both. Tufts University offers a variety of options, including various competitions and prizes from the Derby Entrepreneurship Center, the D-Prize administered by the Fletcher School, and the Friedman Prize offered by the Friedman School.

- Equity-free grants offered by the Government: In the US, this includes grants administered by the United States Small Business Administration (SBA). This includes SBIR and STTR awards. These grants are a good match for technology based ventures that need more runway to harden their technologies before commercialization.

- Equity-free grants offered by various foundations: These are particularly relevant for non-profit ventures which are not a match for VC funding. These can benefit for-profit and non-profit entrepreneurs alike. For example, Venture Well has a number of grant programs benefiting inventors, innovators and entrepreneurs. The Cummings Foundation funds small local non-profits serving communities in need in the Middlesex and Suffolk Counties of Massachusetts.

- For under-represented groups: Additional resources might be available for specific sectors (e.g. AI, FinTech, BioTech, ClimateTech, Social Enterprises) and/or under-represented groups (e.g. persons who identify as female or non-binary, BIPOC, LGBTQIA+). Be sure to search for, and take advantage of, grants and funding that you and your venture are eligible for.

Sources of capital for growth-style startup entrepreneurs

If you are building a growth-style startup, you might be thinking of raising VC money. Contrary to common misconception, your first step will not involve pitching a VC such as Andreeson Horowitz or Sequoia Capital – you will most likely be starting with “angel investors” and progress from there. Following are some pro-tips for you.

- Consider Crowdfunding through Kickstarter, Indiegogo and other crowdfunding platforms: These platforms have made it possible for new ventures to raise money from backers who care about their projects. As mentioned last week – be careful about crowdfunding as it doesn’t always validate what you need to validate and not every venture works well with crowdfunding. Read our knowledgebase section on crowdfunding to learn more.

- Learn the alphabet soup: The VC lexicon is a specific alphabet soup and needs to be memorized: Angel / pre-seed / seed / A, B, C / SPV / SPAC etc. Start with this excellent article from CBInsights on how VCs work, then check out our Knowledgebase section on angel and seed rounds, which typically involve “convertible notes” or “SAFE” notes.

- Make a list of investors that are well matched to your venture’s stage, mission and industry sector: This is the single most important step in the process that will help you effectively manage the fundraising process. We recommend that you make a list of at least 50 investors. The first filter involves the stage of venture and average check size. If you are in a pre-seed stage, looking to raise $1-2M, you will be wasting your time if you pitch a growth-style investor who typically invests in C or D rounds with average check sizes of $50-100M. The second filter is sector affinity. You will also be wasting your time pitching someone who is not investing in your space. For instance, a robotics startup pitching a VC with an investment thesis 100% focused on media tech will not succeed.

- Do due diligence on the investor: For each VC company that you wish to engage, try to find one or more portfolio companies that are building a similar but adjacent business to your venture – and talk to their founders to see what it is like to have that VC on your board. If possible, find out who within the VC firm will be joining your board should they invest. It is utterly critical that you know who you will be getting and verify that you can work with that person before you take their money.

- Manage fundraising like a B2B sales process: At the end of the day, fundraising is very similar to a B2B Sales Process. You will need to generate a list of suspects, qualify your leads by doing background research, then you do the outreach and see how many will talk to you. Once you start talking to them you will have to manage an ongoing conversation with each of them. One good way to keep track of all this is to use a Customer Relationship Management (CRM) system such as Hubspot to make sure all your notes are in one place, and you record each interaction over time.

Sources of capital for non-profit entrepreneurs

If you are building a non-profit, you might think that you don’t need to worry about raising capital. You will “just get donations”. That is a misconception. Raising money for a nonprofit is an active process that requires at least as much energy attention as raising VC money for a startup.

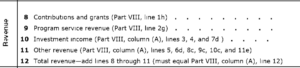

To raise money for a non-profit, the first thing you need to do is to enumerate the viable sources of cash. Most of the time this boils down to the same thing that the US Internal Revenue Service (IRS) requires non-profits registered as a 501(c)(3) tax exempt organization to report on their tax form (Form 990):

Let’s talk about what it all means.

- Contributions are what you might normally think of as charitable donations. This can come in the form of small checks. For example, you might run a Giving Tuesday campaign and collect $5,000 from your supporters in $25 checks. Or you might receive a $10,000 gift from one individual donor who feels passionate about the cause you champion. Contributions don’t just happen. You have to “do the ask” – either anonymously (e.g. through a crowdfunding campaign where you use digital marketing to get the word out) or face to face (“Do you see your way clear towards making a gift of $10,000 in the next six months?”)

- Grants are covered above under “Sources of capital for every entrepreneur”. The most important thing to know about grants is that it is not just about the deadline and the application process. You should try to get to know the people who run the grant-making process so you understand what they are looking for. This helps you make informed decisions on whether to apply for a grant, and if so, which one – and what it takes to win that grant.

- Program service revenue is what we talked about in Week 6. Non-profits CAN charge for services in the US. An example of program service revenue is the tuition that a 16-year-old’s parents might pay to join a 4-week workshop to learn about, say, the Internet of Things (IoT) from a non-profit focused on STEM education for high school students.

- Investment income usually comes later in the game for a non-profit. Investment income is either the interest / dividends from the bank account of a non-profit. For example, if you have a $1M balance in your bank, your Chief Financial Officer might put some of it into fixed income investment products to yield 2-3% over a year’s time. Endowment income is another example. Most universities have large endowments that are managed by professional fund managers working for the school. Each year the university is not allowed to touch the principal but are allowed to spend around 4% of the balance (typically calculated based on the returns for the endowment fund averaged over the past few years). This source of revenue only becomes relevant when there is a large balance in the bank, so it is usually less impactful for a young non-profit.

- Other revenue covers everything that defy classification. For instance, if your non-profit sells SWAG (for example, hoodies, t-shirts, mugs with your logo on it), that probably goes into this category. Or your nonprofit might join an ad network (e.g. Google Adsense) and start to generate revenue on your website based on clicks. This source of revenue also does not tend to be dominant as the total dollar amounts tend to be relatively lower.

For many new non-profits, Contributions, Grants and Program Revenue tend to be the three dominant sources of cash. Of these, Contributions tend to dominate in the early days. It is critical that the non-profit leader understands not only how to do crowdfunding but how to raise money from philanthropists. Phil Buchanan’s “Giving Done Right” is a good book to read to help you understand how philanthropists think and work.

Team and Talent

In the beginning of your venture, your first concern should be finding the right cofounders and making sure you are aligned in values, goals and expectations. As you make progress, you will need to bring on new team members.

Hiring great employees is a big job for any hiring manager – and especially hard for entrepreneurs building a new venture. Your venture is typically less well funded than established companies who are competing with you for the same talent. In most cases, you will not be able to afford the compensation packages that big companies can offer to your candidates. You will need to pitch your first 10 employees differently than if you were trying to hire them to work for you at, say, Google. You will also need to get creative about their compensation package.

Hiring for a new venture starts with finding common ground in what your company is trying to achieve, and what your candidate’s goals and aspirations are.

You can teach skills, but you cannot teach passion. The best early hires are employees whose passions are aligned with your mission and vision – even if they do not check every box in your skills wish list.

Your work as the leader of your venture does not stop once you hire new people. You need to work on creating a high performing team. You need to intentionally define and cultivate a culture that is unique to your venture.

Building and nurturing a team is an evergreen process – if you invest in your team from Day 1, your venture will be more resilient, and will be more successful in navigating obstacles along the way.

Get ready to pull it all together

There are just one and a half weeks to the finish line. We will be wrapping up the accelerator on August 18, 2022 with our Demo Day!

Here are a few things you should do this week to get ready for Demo Day.

- Update your one-page Executive Summary with every win you have achieved since the midpoint checkin.

- Update your 5-minute pitch in the style of the Techstars Boston Demo Day – integrating all the feedback you have received since then

- Check that your basic marketing presence will pass scrutiny

- Check that your 5-year pro-forma projections make sense

Additional Resources

For more information, check out Module 6 of our Learning Center.

Also review weekly updates from this summer for reference.